Prior to the execution of this business combination agreement, East Stone has terminated its previously announced business combination agreement with JHD Holdings (Cayman) Limited. NWTN’s Founder and Chairman, Alan Wu, is expected to continue to lead Pubco after the closing of the Business Combination. Securities and Exchange Commission (the “SEC”) completes its review of the proxy statement/prospectus relating to the proposed Business Combination, the receipt of certain regulatory approvals, and approval by The Nasdaq Stock Market to list the securities of Pubco. The boards of directors or similar governing bodies of NWTN and East Stone have approved the proposed Business Combination, subject to, among other things, the approval by East Stone’s shareholders of the proposed Business Combination, satisfaction of the conditions stated in the Business Combination Agreement and other customary closing conditions, including that the U.S. We believe that NWTN’s insights on the value of the passenger-centric experience will drive NWTN into a blue ocean market with enormous opportunity, functioning as the hub of future intelligent mobility life,” said Xiaoma “Sherman” Lu, Chief Executive Officer of East Stone. “In NWTN we have found a company that has the vision, courage and talent to change the automobile industry. Its first model SEVEN and second model MUSE have received industrywide recognition at various global auto shows. NWTN’s primary target consumers are technology-savvy families and businesses who are becoming increasingly environmentally-conscious. All these technical elements, along with unique design language, contribute to NWTN’s vision of passenger-centric experience. NWTN’s core technology advantages are characterized by modular pure electric platform, digital on-board connectivity system, continuously-upgraded electric and electronic architecture as well as autonomous driving technology.

Headquartered in Dubai, the United Arab Emirates (UAE), NWTN is a green mobility technology company which defines the Smart Passenger Vehicle (“SPV”) as a vehicle concept emphasizing AI technologies, autonomous driving and personalized passenger experience. The transaction represents a post-combination valuation of $2.5 billion ($2,500,000,000) for NWTN upon closing, subject to adjustment. The outstanding shares of NWTN and East Stone will be converted into the right to receive shares of the Pubco.

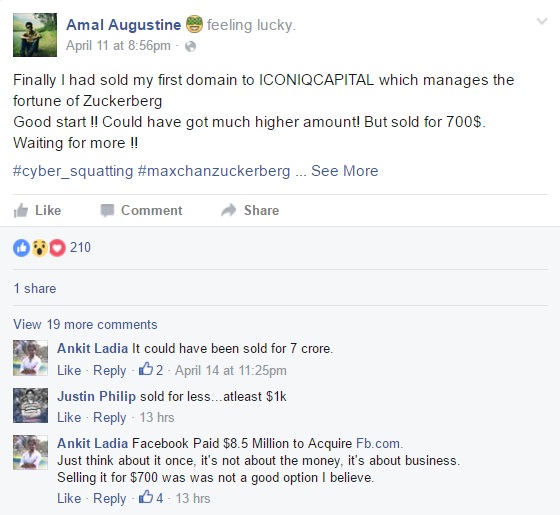

Upon consummation of the two mergers and the other transaction contemplated by the Business Combination Agreement (the “Business Combination”), NWTN, Inc., a newly formed subsidiary (the “Pubco”) will seek to be listed on the Nasdaq Stock Market. Burlington, MA and Dubai, UAE, Ap(GLOBE NEWSWIRE) - East Stone Acquisition Corporation (Nasdaq: ESSC) (“East Stone”), a publicly traded special purpose acquisition company, and ICONIQ Holding Limited (“NWTN”) announced today that they have entered into a definitive Business Combination Agreement (the “Business Combination Agreement”).

0 kommentar(er)

0 kommentar(er)